Healthcare remains one of the most significant considerations in the Western world. While Canada’s situation differs from that of the US, as well as EU nations and even the UK, there are ongoing issues affecting Canada’s healthcare industry, including wait times and resource allocation challenges. How much does Canada spend on healthcare every year? According to the Canadian Institute for Health Information (CIHI), in 2024 Canada spent $372 billion on healthcare, which equates to $9,547 per Canadian citizen – a substantial increase reflecting inflation, population growth, and post-pandemic healthcare investments.

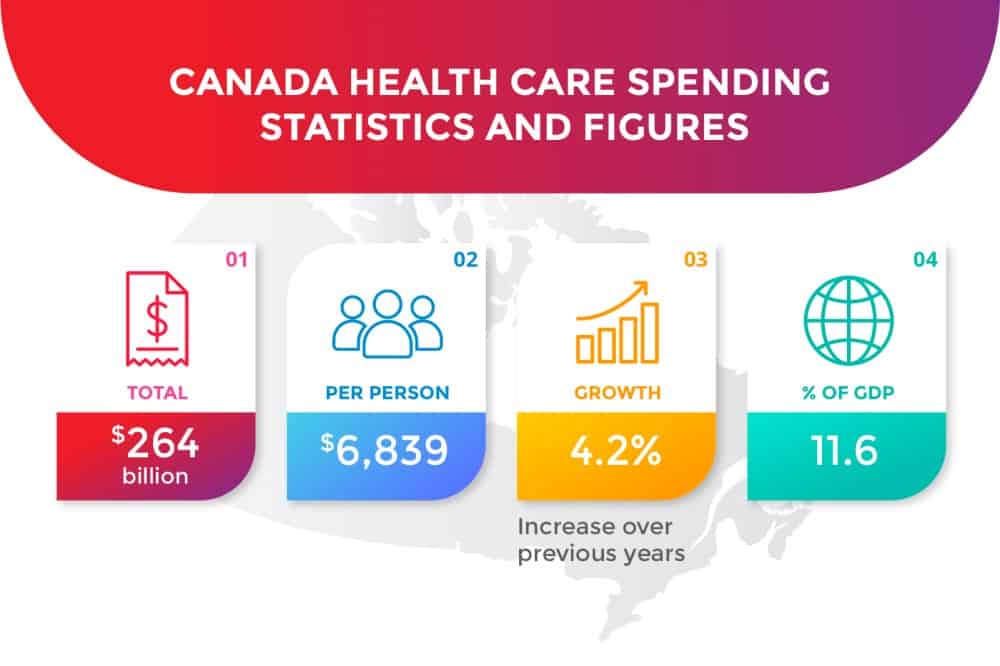

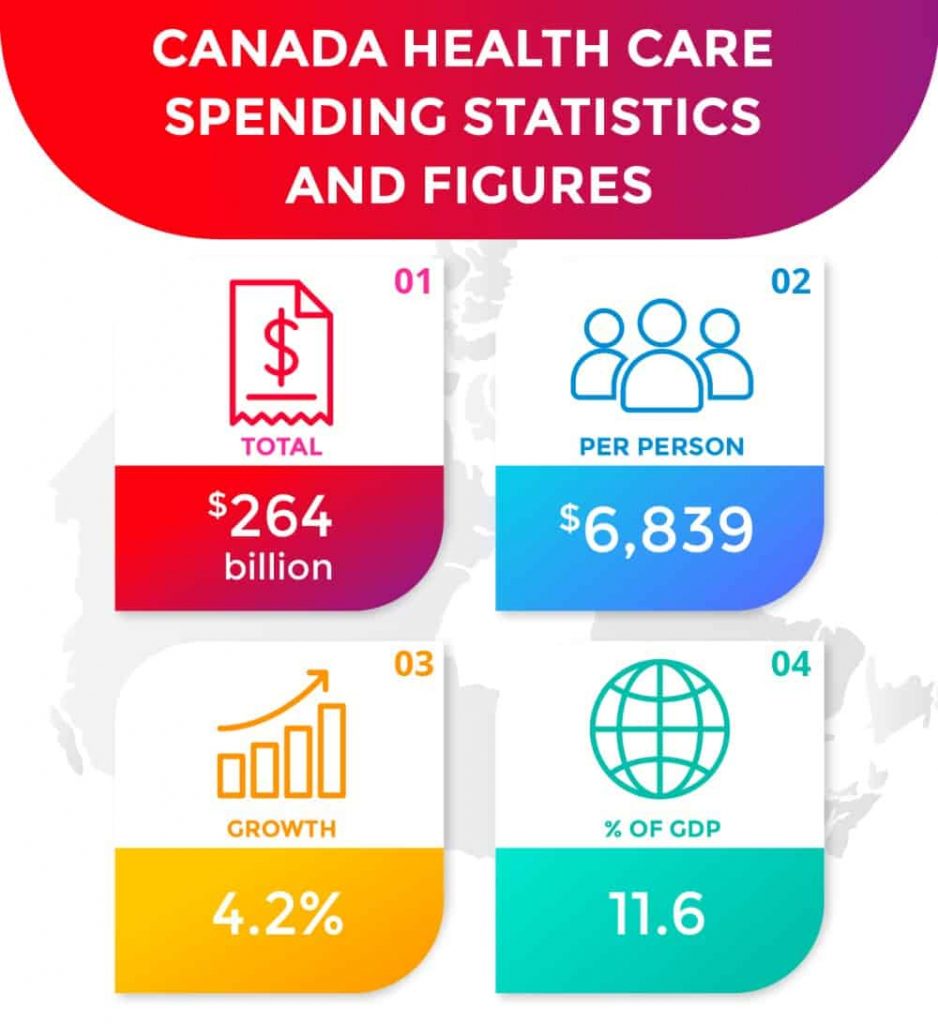

Canada Health Care Spending Statistics and Figures

To put how much Canada spends on healthcare into perspective, let’s examine the current financial landscape and recent trends.

2024 Healthcare Spending Breakdown

- Total: $372 billion

- Per Person: $9,547

- Growth: 5.8% increase over previous year

- % of GDP: 12.4%

- Public Share: 71.2%

- Private Share: 28.8%

According to Dr. Sarah Mitchell, a health economist at the University of Toronto, “The significant increase in healthcare spending reflects not just inflation, but strategic investments in digital infrastructure, mental health services, and pandemic preparedness that have fundamentally reshaped Canada’s healthcare landscape.”

Canada’s healthcare spending has experienced notable acceleration since 2020. The COVID-19 pandemic marked a turning point, with healthcare spending jumping from 11.6% of GDP in 2019 to 13.1% in 2021, before stabilizing at 12.4% in 2024. This represents the most significant sustained increase since the system’s establishment, driven by pandemic response, digital health investments, and addressing treatment backlogs.

Historical Trends and Projections

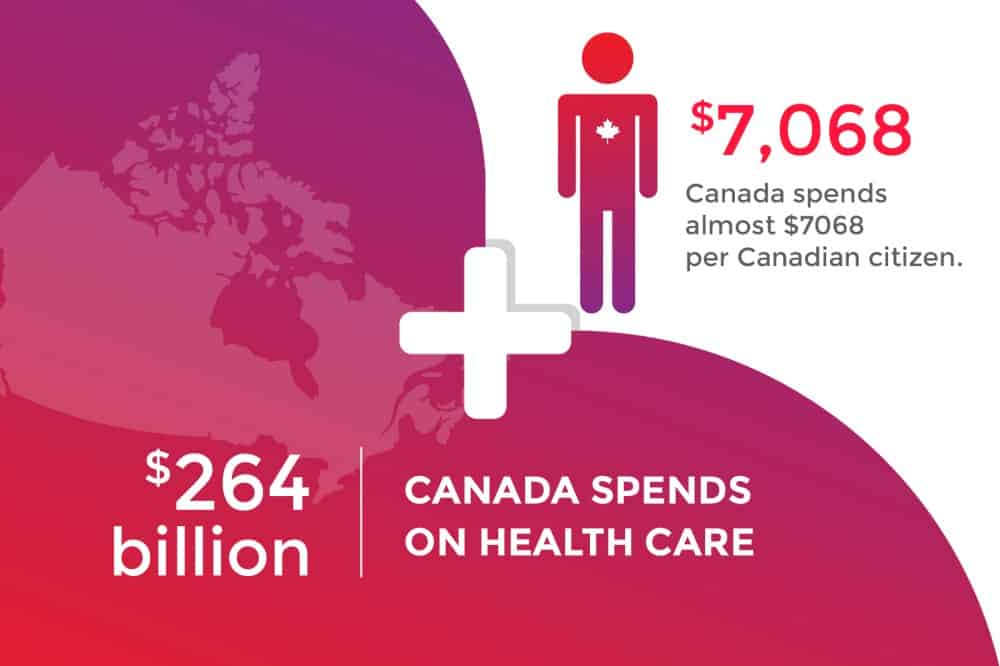

- 2019: $264 billion (11.6% of GDP)

- 2020: $295 billion (12.8% of GDP)

- 2021: $321 billion (13.1% of GDP)

- 2022: $339 billion (12.9% of GDP)

- 2023: $352 billion (12.6% of GDP)

- 2024: $372 billion (12.4% of GDP)

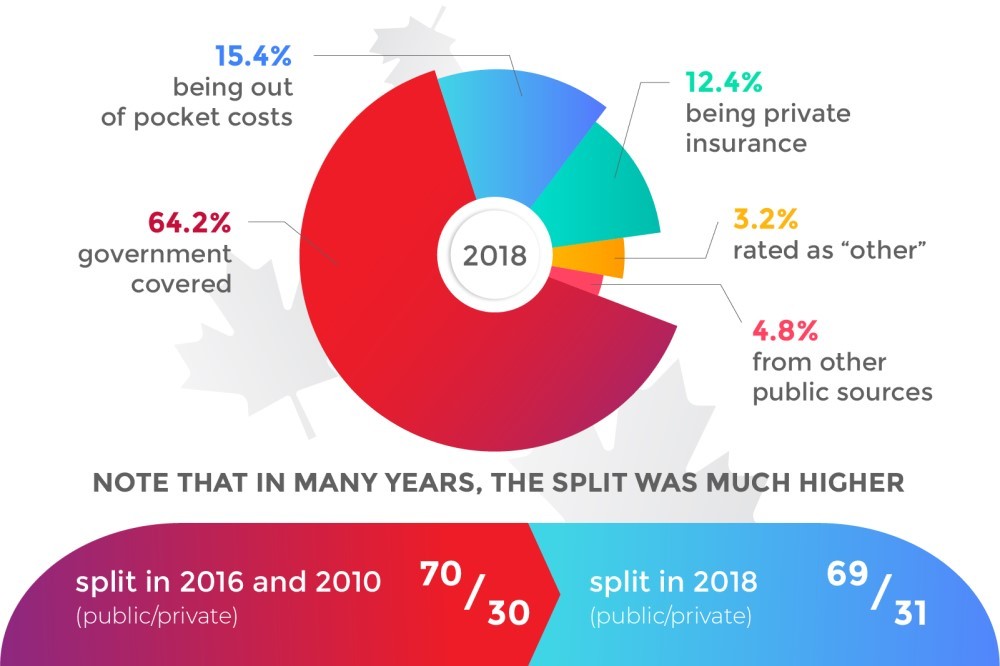

How Is Canadian Health Care Funded?

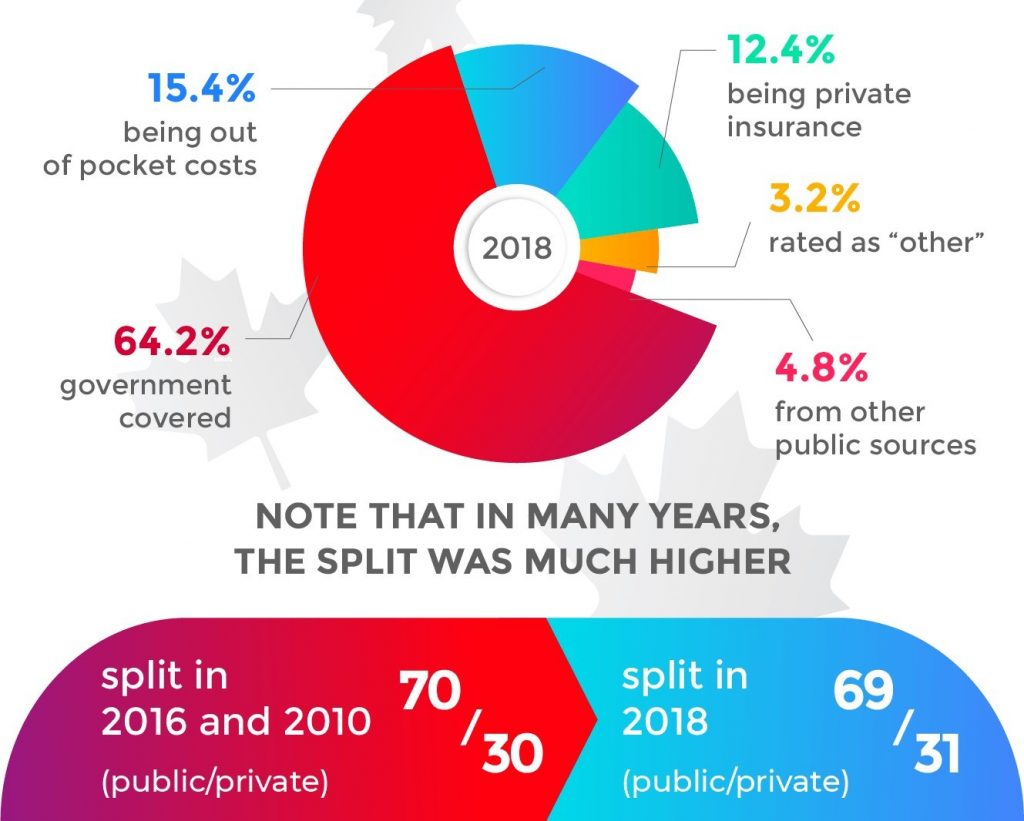

Canadian healthcare funding has evolved significantly since 2019, with the public-private split shifting in response to pandemic investments and policy changes. In 2024, 28.8% of Canadian healthcare costs were covered by the private sector, with 14.2% being out-of-pocket costs, 11.8% being private insurance, and 2.8% rated as “other sources”. In comparison, governments covered 71.2% of the costs, representing an increase in public funding compared to pre-pandemic levels.

Funding Split Comparison: Then vs Now

- 2018: 69% Public / 31% Private

- 2021: 73% Public / 27% Private (pandemic peak)

- 2024: 71.2% Public / 28.8% Private

The increased public share reflects substantial federal investments in pandemic response, mental health services, and long-term care improvements across provinces and territories.

How Does Health Care Funding in Canada Work?

Unlike the United States, Canada maintains a single-payer healthcare system funded through tax dollars. This publicly funded healthcare covers medically necessary hospital and physician services. However, notable gaps remain, including prescription drugs, long-term care, home care, and dental services. Recent developments have begun addressing some of these gaps:

- National Dental Care Program: Launched in 2024, providing coverage for children under 12 and expanding to seniors by 2025

- Pharmacare Initiative: Federal legislation passed in 2024 establishing framework for universal prescription drug coverage

- Mental Health Transfers: Dedicated federal funding stream for provincial mental health programs

Provincial and territorial governments continue to develop programs that offset costs in uncovered areas, with significant variation across regions. Private insurance remains crucial for areas not covered by the Canada Health Act, while charitable funding supports hospital infrastructure and specialized programs.

The majority of funds comes from taxpayers, but the funding model continues to evolve with new federal initiatives.

The flow of healthcare funding follows the federal-provincial transfer system through the Canada Health Transfer (CHT), which replaced the previous Canada Health and Social Transfer. This system ensures predictable funding increases while maintaining provincial autonomy in healthcare delivery. Federal transfers are supplemented by provincial taxation and, increasingly, targeted federal programs addressing specific health priorities.

Provincial Variations in Healthcare Spending

Healthcare spending varies significantly across provinces, reflecting different demographics, economic conditions, and policy priorities:

- Alberta: $11,842 per capita (highest, due to higher wages and resource economy)

- Ontario: $9,234 per capita (close to national average)

- Quebec: $8,967 per capita (efficient delivery model)

- Atlantic Provinces: $10,500+ per capita (aging populations, rural challenges)

- British Columbia: $9,445 per capita (growing population, urban concentration)

Key Factors in Health Care Funding in Canada

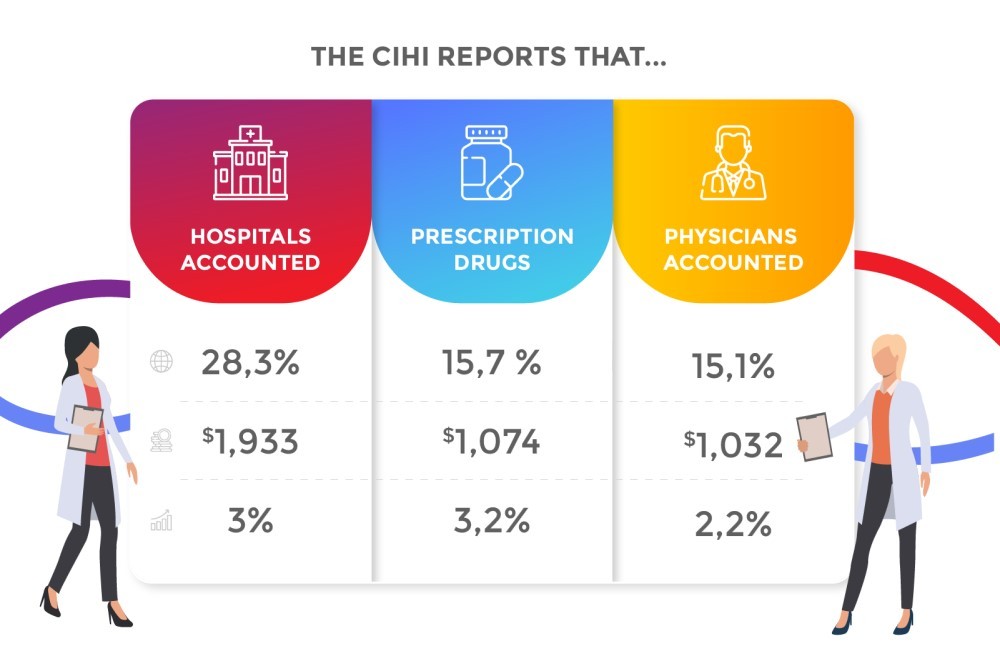

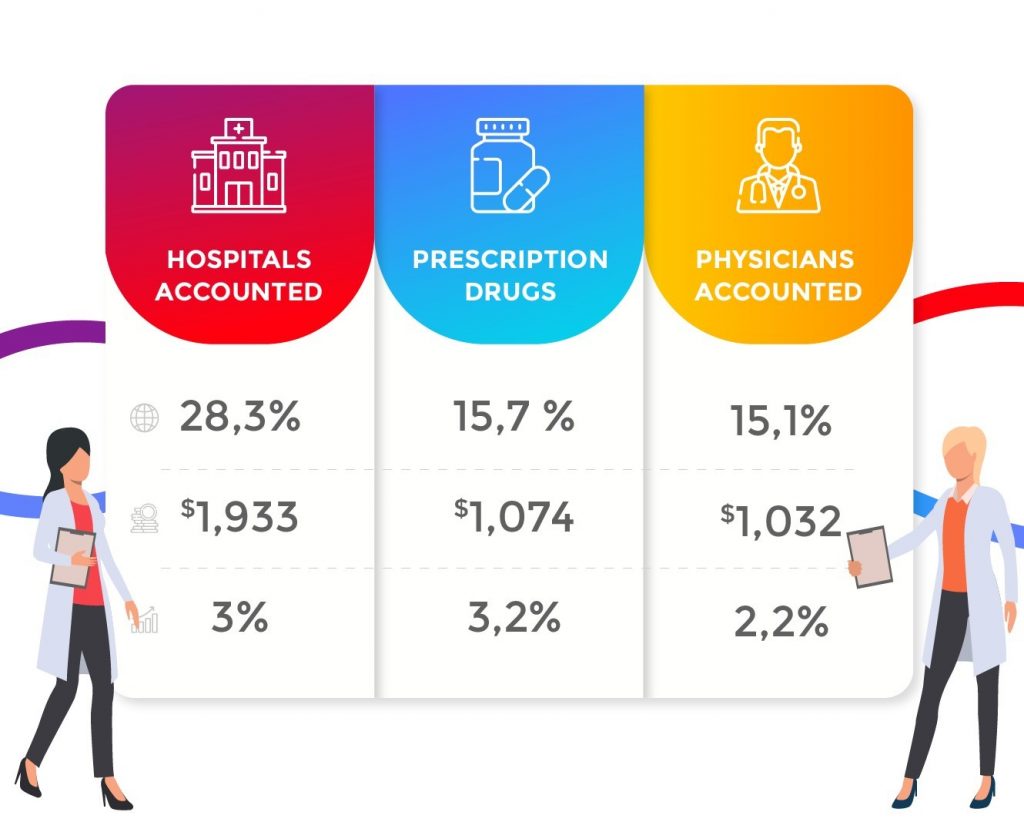

Breaking down Canada’s $372 billion healthcare spending reveals where resources are allocated and how priorities have shifted since 2019. The spending distribution reflects both traditional healthcare needs and emerging priorities:

- Hospitals: 26.8% of spending ($2,558 per person, 4.1% growth)

- Prescription Drugs: 16.9% of spending ($1,613 per person, 5.2% growth)

- Physicians: 14.3% of spending ($1,365 per person, 3.8% growth)

- Digital Health & Technology: 3.2% of spending ($305 per person, 24% growth)

- Mental Health Services: 7.4% of spending ($706 per person, 12% growth)

Hospital spending patterns have evolved significantly since 2019. While hospitals still represent the largest single spending category, their share has decreased slightly as resources have shifted toward community-based care and digital health solutions. The pandemic accelerated the trend toward outpatient treatment, with virtual care options reducing traditional hospital utilization. Staff compensation continues to account for approximately 65% of hospital budgets, up from 60% in 2019, reflecting both wage increases and retention challenges.

Emerging Cost Drivers

Dr. James Chen, a healthcare policy analyst at the Canadian Public Policy Institute, notes that “We’re seeing fundamental shifts in spending patterns, with mental health, digital infrastructure, and aging-in-place supports representing the fastest-growing segments of healthcare expenditure.”

- Aging Population: Canadians over 65 account for 44% of healthcare spending despite being 19% of population

- Chronic Disease Management: Represents 67% of healthcare costs, up from 60% in 2019

- Technology Integration: Electronic health records now cover 89% of Canadians

- Preventive Care: Investment increased 34% since 2020, focusing on early intervention

The Future of Canada Health Care Spending

The healthcare industry continues to evolve rapidly, with technology and demographic changes driving new investment priorities.

Canada’s healthcare spending trajectory through 2030 will be shaped by demographic shifts, technological advances, and policy innovations. Current projections suggest healthcare spending will reach $435 billion by 2028, representing 12.8% of GDP. Key trends shaping this growth include:

Major Trends Shaping Future Spending

- Digital Health Expansion: Telehealth utilization remains 300% higher than pre-pandemic levels, with virtual care integration reducing costs while improving access. AI-powered diagnostic tools and remote monitoring systems are projected to save $2.1 billion annually by 2028.

- Integrated Health Systems: Hospital consolidation continues, with 23% fewer independent hospitals than in 2019, creating regional health networks that improve coordination but may impact local access in rural areas.

- Demographic Pressure: By 2030, seniors will represent 23% of Canada’s population, requiring specialized care models. Long-term care spending alone is projected to increase 8.2% annually through 2030.

- Preventive Care Investment: Evidence-based prevention programs are expanding, with early intervention in diabetes, cardiovascular disease, and mental health showing significant ROI – every $1 invested saves $4.20 in treatment costs.

- Pharmacare Implementation: Universal prescription drug coverage, phased in through 2027, will shift $18 billion in private costs to public funding while reducing overall drug spending through bulk purchasing.

Sustainability Challenges and Solutions

Healthcare sustainability requires balancing growing demand with fiscal responsibility. Innovative funding models are emerging:

- Value-Based Care: Payment models linking provider compensation to patient outcomes rather than service volume

- Social Determinants Investment: Housing, food security, and education programs that address root causes of health issues

- Public-Private Partnerships: Strategic collaborations in areas like medical technology and facility management while preserving public healthcare principles

- Pan-Canadian Procurement: Coordinated purchasing of medical supplies and pharmaceuticals to leverage economies of scale

In Conclusion

Canada’s healthcare system represents a $372 billion investment in the health and well-being of its citizens. Funded through a combination of government contributions, charitable support, and private insurance, the system continues to evolve to meet changing demographics and health needs. While challenges remain, including wait times, rural access, and sustainability concerns, Canada’s commitment to universal healthcare remains strong.

The post-pandemic healthcare landscape has accelerated innovation in digital health, mental health services, and integrated care delivery. As Canada moves toward 2030, strategic investments in prevention, technology, and system integration will be crucial for maintaining a healthcare system that serves all Canadians effectively and sustainably.

Other interesting articles: